The strategic advantage of assessing climate risk now

Ongoing uncertainty around climate-related disclosure laws can lull some companies into a state of inaction. But climate disclosure is in our future. This includes conducting risk assessments, which provide invaluable insights and opportunities for businesses.

Orion Fulton

Associate Principal

Mike Mieler

Associate

The US has seen waves of ambitious climate disclosure regulations as well as setbacks in the past few years, leading many businesses to adopt a wait and see approach to reporting. The long-awaited Securities and Exchange Commission (SEC) rules for public companies to disclose carbon emissions and climate risk have been paused due to legal challenges, and two California disclosure laws signed in 2023 may be delayed. However, this is no time for complacency.

Regardless of a company’s disclosure requirements, those that prioritize their efforts to identify, evaluate, and disclose climate-related financial and non-financial risks are better positioned to protect their organizations from the impacts to their business from climate-related hazards and transition to a low-carbon economy. They can also find opportunities for creating corporate value and protect long-term financial returns.

Increased stakeholder and investor pressure for transparent, comparable climate-related information is leading many companies to structure their organizations for sustainability reporting and resiliency planning. Investors and stakeholders have long been interested in companies’ efforts to reduce carbon emissions, but with the growing physical impacts of climate-related hazards they are increasingly concerned about how climate hazards will affect businesses and how companies will adapt. A 2024 Institutional Investor Survey in North America and Europe revealed they believe “overwhelmingly that climate change will impact their portfolios in the coming years.”

A widening net of regulations

Not least, a growing trend of global and US reporting requirements focused on climate change and greenhouse gas (GHG) emissions will inevitably impact US companies. In the void of the SEC’s rules, California’s two groundbreaking laws, SB 253 and SB 261 are even more aggressive. They require both publicly traded and private companies based in or doing business in the state to report GHG emissions and climate-related financial risks.

SB 253’s Scope 3 requirement for indirect GHG emissions will have wide-ranging implications for many companies indirectly, such as for suppliers who may not be covered by the laws. These laws, which require enactment through regulations from the California Air Resources Board (CARB), are expected to apply to thousands of companies. One study estimated 73% of Fortune 1000 companies could be subject to SB 253 and SB 261. The laws are slated to go into effect beginning as early as 2026.

Even if legal challenges delay these compliance deadlines, the California laws have established a new standard and set in motion the development of mandatory climate disclosure policy in states across the nation, including Washington, Illinois, Minnesota, and New York. Both the Canadian Securities Administrators (CSA) and the Canadian Sustainability Standards Board are in the process of developing standards and requirements for companies to disclose climate risks and opportunities, with the CSA’s applying to public companies.

Globally, even more stringent, mandatory emissions and climate-related financial risk reporting, including for Scope 3, are starting to impact multinational organizations in the US, whether public or private. The European Union has begun phasing in reporting requirements for its Corporate Sustainability Reporting Directive (CSRD), which is estimated to apply to thousands of US-headquartered firms. In fact, SEC Chair Gary Gensler noted that the lack of a US rule could compel many US-based multinational corporations to comply with the EU’s CSRD.

The risk assessment advantage

Irrespective of when organizations may be facing climate disclosure, they are at a significant advantage if they assess their climate risk now. The process can reveal important business insights, helping entities minimize climate-related damage, ensure business continuity and thus create value by avoiding losses, producing new funding sources (i.e. through federal grants), or making resilience a play for competitive advantage.

For DC Water, the water authority for the District of Columbia, resiliency is a key part of ensuring the reliability of high-quality water and wastewater services for over 2.5 million customers. Arup has been working with the Authority to report its mitigation strategies and climate, financial, and operational resiliency performance through its Environment, Social, and Governance (ESG) reports since 2021. These ESG reports provide valuable information to rating agencies and investors, which impacts DC Water’s creditworthiness and access to capital to fund resiliency projects and holds it accountable to investors.

DC Water’s enterprise risk assessments have revealed critical insights leading to initiatives for mitigating climate hazards and protecting their assets. In one case, an assessment identified flood hazard as a key climate threat, revealing the need for a floodwall around an advanced wastewater treatment plant to protect it from a potential 500-year storm event. As an important investment to mitigate future risk, DC Water is proceeding with its development, securing $20.3m in federal funding to complete a major segment of the floodwall.

DC Water’s enterprise risk assessments have revealed critical insights leading to initiatives for mitigating climate hazards and protecting their assets.

Demystifying your risk

The level of climate disclosure and amount of action an organization undertakes can vary greatly and depends on a range of factors including its size and industry, where it does business, and its existing climate commitments. The best way for companies to understand the extent and elements of dangerous exposure to their assets is to conduct a natural hazard and climate risk assessment. Until recently, the industry has lacked an established framework or guidance for risk assessments, leaving stakeholders poorly supported with inconsistent systems and varying degrees of resolution among data or consulting service providers.

To address this vacuum and make it easier for organizations to understand their vulnerability to climate hazards, Arup developed standardized levels of assessment that we have used with dozens of our clients globally for several years. We recently made this climate risk and resilience assessment system for buildings available to public.

The framework provides the detail and consistency needed for an organization to assess their climate risk and understand their options for resilience and adaptation actions. Its core structure, the Risk Class Taxonomy, outlines progressively more detailed levels of assessment from a “Basic Hazard Screening” to “Advanced Risk Modeling.” Each level or class explicitly articulates risk assessment methods, data needs, data quality, and typical outputs relative to its class.

Data centers are a particularly trenchant example of an asset type that calls out for assessments in the face of hazards from a changing climate. Since they support systems such as 911 call centers, government websites and services, transportation infrastructure, healthcare facilities, and financial services, data centers are increasingly seen as critical infrastructure essential to public safety, security, health, and economic stability.

We’ve worked with numerous owners of networked data centers using varying levels of risk assessment. This process unlocks insights about the assets within their portfolios that are at highest threat of damage and disruption across a range of climate hazards, such as heat waves, drought, hurricanes, flooding, and sea level rise. These insights inform where prospective data centers might best be sited and what mitigation strategies should be targeted for existing sites.

Acting on insights

Ideally, a company will conduct its assessment and implement a strategy a few years before they plan or need to report, giving them time to fully test out their strategy and identify the best avenue for disclosure. By illuminating a resilience strategy’s cost-benefit, assessments enable businesses to more confidently invest in mitigation and adaptation measures and lower-carbon technologies.

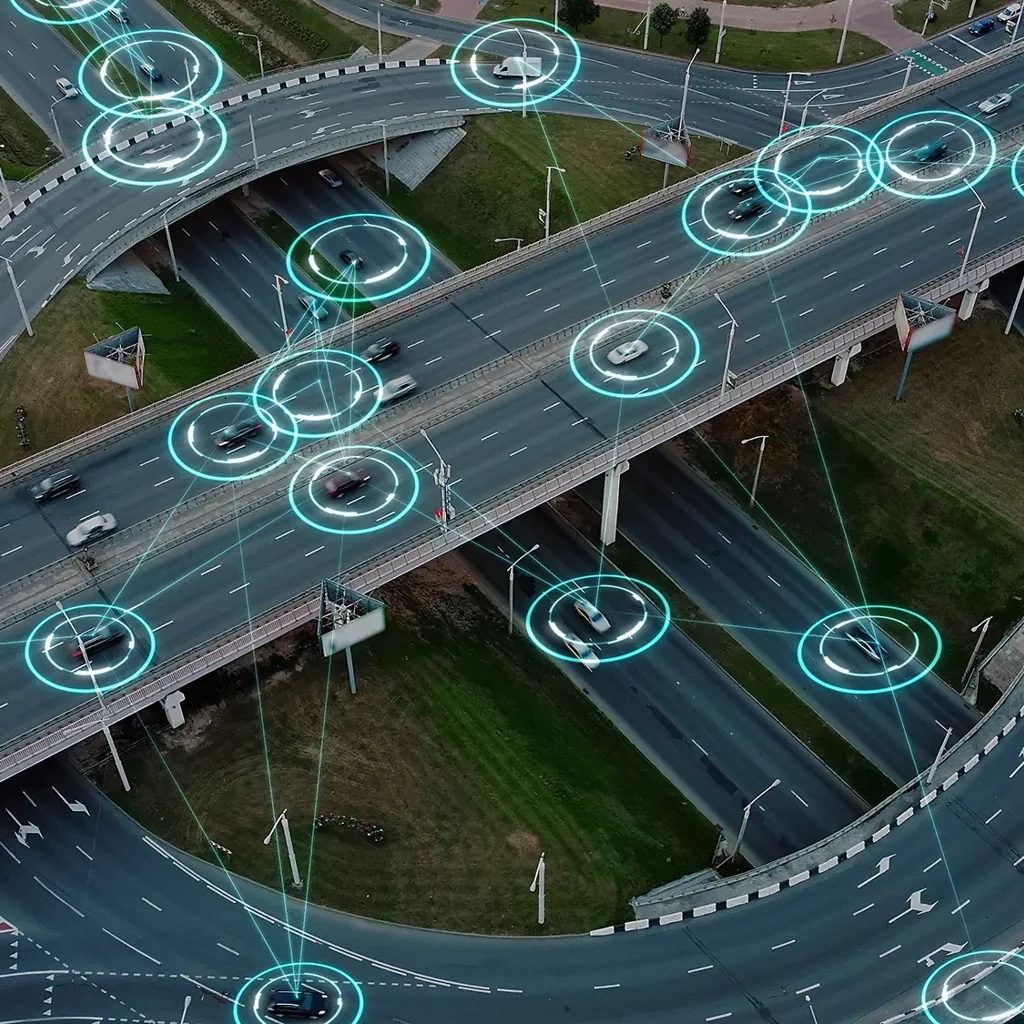

This is also where companies can uncover opportunities. For example, a transportation infrastructure agency is benefiting from its transition to lower-carbon technology by installing solar panels for its power needs, which lowers the agency’s own cost of power and carbon footprint. Recognizing the potential of its right of way, the agency is also expanding its solar program to generate additional revenue by leasing land to nearby organizations to install their own panels and reduce their impacts as well.

Organizations proactively implementing resiliency measures can also increase the intangible value of their company. For example, to better retain tenants and attract new ones, a major commercial developer protects its properties from flooding and creates a safe environment for tenants with a portable, inflatable flood wall. In the case of storm surges or rainfall, it can quickly position the barrier at affected sites.

Transition risk results from the uncertainty of evolving to a low-carbon economy. Changing legislation, evolving market and consumer preferences, and societal expectations all contribute to this uncertainty. Its effects can include material impacts on the operations and reputation of a business and the value of its assets, or the challenges and opportunities arising from shifts in demand, market price, and technology changes. Opportunities can arise from diversifying products and services to improve resilience, and from investing in cleaner energy to reduce costs and improve carbon footprints.

In contrast, physical risk refers to climate change’s potential to cause damage to assets and disruption to critical business operations, including increased acute or chronic natural hazards, such as wildfires, hurricanes, floods, or sea level rise. Increasingly, companies are understanding the value of a comprehensive approach to risk assessment that encompasses both transition and physical risk and climate-related opportunities.

Embedding climate risk in governance

For an increasing number of companies across all sectors, achieving compliance and making the business case for developing climate risk and resiliency plans are one and the same. Some organizations, such as DC Water, have realized that fully integrating their business strategy and operations, ESG goals, and risk management programs, makes the most sense. This enterprise-wide approach enables more accurate data collection, accountability, measurement of key performance indicators, and informed decision-making for climate adaptation. It is the often-overlooked Governance aspect of ESG that can make climate resilience a more routine part of doing business, which can be measured and tracked.

The most important decision related to climate risk is to take action. While not all companies will be ready to unify their strategies and operations and transform their enterprises, climate disclosure rules and increasing climate-related impacts are in our future. Ongoing climate risk assessments and good governance will leave organizations stronger as businesses, with greater appeal for investors, more responsive to a transition market, and with an ability to turn another cost into a source of value

.

Get in touch with our team